Tesla investigations by regulators add risk for investors who envision the electric car company as another in a succession of entrepreneurial successes by its founder and CEO Elon Musk.

The probes, reportedly by the Department of Justice and the Securities and Exchange Commission (SEC), come at an inopportune time as financial pressure mounts for Tesla Inc. (NASDAQ:TSLA) to turn a profit in the third quarter that ends on Sept. 30. The combination of Tesla investigations not only create ???monetary risks??? from civil lawsuits but also raise the possibility that Musk may be pressured to leave as CEO, depending on the findings and severity of any legal violations, according to a recent research note by Brian A. Johnson, an auto analyst at Barclays.

The extent of the risks from the ongoing Tesla investigations will hinge on what regulators determine in their fact gathering and conclude about whether public tweets and comments from Musk about taking the electric car company private were intentional attempts to deceive investors, negligent, reckless or something else, Johnson wrote in his research note. To help assess the level of risk from the Tesla investigations, he sought guidance from Daniel Walfish, an attorney at Walfish & Fissell LLP, who previously had spent five years at the SEC???s Enforcement division, to offer his insights.

Tesla Investigations Escalate with Justice Department Now Involved

Company officials publicly characterized the Department of Justice???s inquiry as a request for documents in August, without pursuing subsequent subpoenas or interviews. The involvement of the Department of Justice heightens the risk faced by Musk and Tesla, since that federal agency prosecutes federal criminal offenses, whereas the SEC???s enforcement is civil and limited to assessing penalties and barring violators from engaging in certain future securities activities, according to Barclays??? Sept. 19 research note.

One possibility is that the Department of Justice will not prosecute Musk or Tesla for a Rule 10(b)(5) violation, which would entail an ???intent to deceive.??? Elements of a 10(b)(5) violation include that any statement, such as private tweets, was ???material??? and made with ???scienter,??? which is not just full-blown intent but includes ???recklessness??? that involves a danger to the market, Barclays added.

Musk???s potential defenses include indicating he truly believed he would get the funding he described in an Aug. 7 tweet as ???secured,??? though he only required shareholder approval and needed to discuss the idea of privatization with large shareholders, according to the Barclays research note. As a company, Tesla???s attorneys could argue that Musk was acting as a private bidder and not an official representative of the organization when he tweeted from his personal account.

???The SEC does a good job of not leaking during the investigation processes, preferring to build its case privately,??? Barclays noted.

Tesla Investigations and Findings Could Help Civil Lawsuits of Short Sellers

Certain short sellers, who bet on the company???s share price falling, are taking legal action against Tesla and Musk, but the process of adjudication could take years. Even if the Justice Department found Musk sought to harm short sellers with his tweet about ???funding secured??? to take the company private, prosecutors would need to convince a jury that such risk-taking investors are worthy of protection, according to Barclays.

???The range of damages and hence an ultimate settlement is difficult to assess, as much of the trading after the ???funding secured??? tweet was likely high frequency traders with only modest losses, if any,??? according to Barclays.

Tesla announced late on Friday, Aug. 24, that its board of directors evaluated the idea of privatization but chose to stay public, despite Musk???s continuing frustration with short sellers who try to profit when the company???s stock price drops.

Tesla Investigations Could Hinder Company???s Future Financings

???With Tesla likely needing to raise capital soon, the company may want to look to settle with the SEC,??? said Hilary Kramer, who offers the Value Authority advisory service that has produced double-digit-percentage profits in its last six trades.

"It is almost impossible to believe that Musk's now infamous ???funding secured??? comment was not an attempt to hurt short sellers,??? said Hilary Kramer, a Wall Street veteran who recently recommended the sale of Ford to subscribers of her Turbo Trader and Inner Circle advisory services. ???Musk probably knew his comments would not have any long-term impact, but he just decided to lash out under pressure."

One market observer who appreciates Musk???s entrepreneurial acumen but is concerned with his conduct is Jim Woods, who heads the Intelligence Report and Successful Investing advisory services.

???For TSLA shareholders, one of the most troubling, and unfortunately self-inflicted, risks to the stock has come from Elon Musk and his penchant for public eccentricity,??? Woods told me. ???As a fan of Musk the genius, I celebrate his unconventional thinking. However, if I were a shareholder, I would feel very uncomfortable about the potential legal can of worms Musk opened with his premature ???going private??? tweet.???

Tesla Investigations Add Risk for Investors in Funds that Hold It

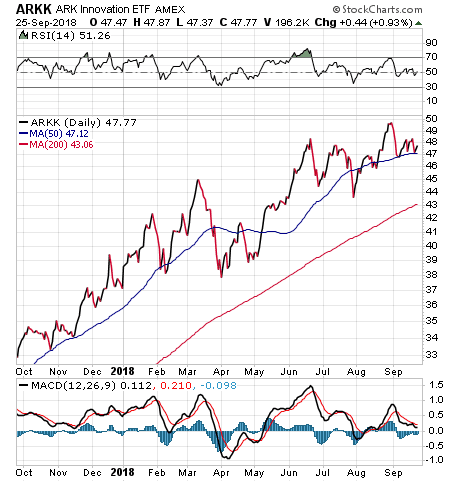

Dr. Mark Skousen, who heads the Forecasts & Strategies investment advisory service, still profitably recommends the ARK Innovation (NYSE:ARKK) fund, but he expressed skepticism about it continuing to hold onto shares of Tesla, since the electric car company???s debt level is ???insurmountable,??? he wrote in a Sept. 24 update.

Chart courtesy of stockcharts.com

???We will continue to monitor this situation,??? he wrote to his Forecasts & Strategies advisory service subscribers, who notched a 64.1 percent return in Ford Motor Co. (NYSE:F) between December 2009 and January 2011 when the vehicle manufacturer overcame severe financial distress. However, Skousen currently is not recommending Tesla or any auto company.

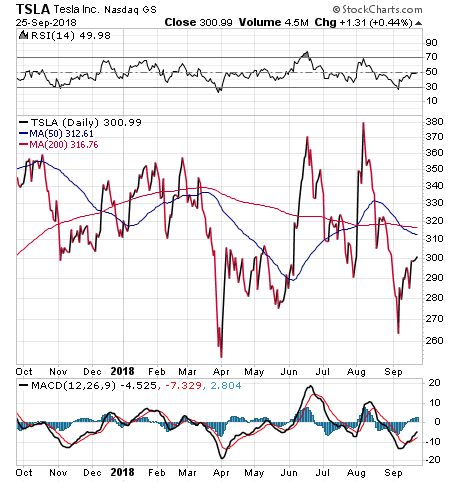

Goldman Sachs issued a research note on Tesla on Sept. 24 that found Tesla???s third-quarter 2018 new car deliveries will ???slightly??? exceed the consensus estimates of analysts who cover the company. However, Tesla faces growing competition in the years ahead that keeps Goldman???s price target for the company at $210 a share, well below its closing price of $300.99 a share on Sept. 25.

Chart courtesy of stockcharts.com

With Tesla expected to announce its third-quarter deliveries shortly after the end of the three-month period on Sept. 30, as it typically has done, investors will not need to wait long to find out if the company???s efforts to boost production are paying off. Tesla???s goal of achieving a third-quarter profit may well hinge on how much above analysts??? forecasts the company performs and whether it can sustain momentum in future quarters as competition, regulators and civil litigators pose risks down the proverbial road ahead.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor???s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore???s Daily Record newspaper. Paul also is the author of an inspirational book, ???Holy Smokes! Golden Guidance from Notre Dame???s Championship Chaplain,??? with a foreword by former national championship-winning football coach Lou Holtz.