By Bryan Perry, new Eagle Financial Publications Investment Expert

The holiday-shortened week saw the S&P rally to a new all-time high, crossing the psychological 2,100 level followed by some too-tempting-to-pass-up profit taking. The key catalyst may have been optimism about a debt deal for Greece. Though negotiations are still underway, the market wants to hold its recent gains.

Taking an economic view of the investing landscape, most of the recent data points continue to come in under consensus estimates. This past week, the Commerce Department reported that housing starts fell 2% to an annual rate of 1.07 million, while building permits also declined. Single-family home construction was down nearly 7% from the previous month, but construction of multi-family homes rose 7.5%. Industrial production rose by only 0.2% for January, short of the 0.4% forecast. Core PPI for last month slipped to -0.1% against a forecast calling for a 0.2% rise, and Leading Indicators for January also came in short of expectations, posting a small gain of 0.1%, versus 0.2% consensus.

Normally, a string of weaker-than-expected economic data would invoke at least a modest rally in the Treasury market. However, the fear of future Fed tightening that has gripped investor sentiment of late has the benchmark 10-year T-Note holding at around 2.1%. The most recent minutes from the Federal Open Market Committee (FOMC) meeting revealed some fresh caution by the Fed, citing languishing deflationary pressures. According to CME FedWatch, which tracks Fed funds futures contracts, bets on a June rate hike eased to slightly more than a 70% probability on Wednesday from just over 72% on Tuesday prior to the release.

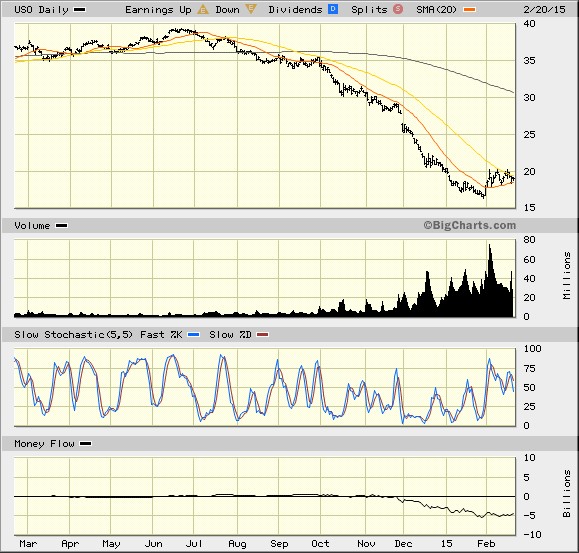

The quandary for the Fed is that economic growth is often accompanied by an uptick in inflation. Though the labor market has added jobs, wage growth has been minimal at best. Gold prices, typically a good inflation barometer, are getting slammed, testing $1,200/oz. A big slowdown in construction in China has severely hit many base commodities. While WTI crude traded as high as $53.85 in the past week, it stalled out up against its 50-day moving average and is now testing key near-term support at $50/bbl. If the $50/bbl level is broached, further downside pressure in oil prices should ensue. The following chart shows the trading trends for United States Oil ETF (USO).

Regardless of any yellow caution flags that the economic calendar and the commodities sector might be waving, investors remain confident that cheap energy, low lending rates and a Federal Reserve that is likely to sit tight on "normalizing" interest rates are ultimately good news for consumers and buyers of equities and high-yield assets.

Within the scope of where income-oriented investors should reach for yield in the current low-inflation, low-interest-rate climate with the market poised for Fed tightening, the obvious place to look for yield and upside appreciation is floating-rate assets. They can be in the form of real estate investment trusts (REITs), Business Development Companies (BDCs), Master Limited Partnerships (MLPs), Short-term Distressed Credit Funds, Convertible Debt Funds and Covered Call Funds that own market-leading stocks.

The current model portfolio for Cash Machine subscribers reflects this current market view, with the majority of holdings fitting this very profile that will benefit greatly if/when inflation does rear up and if/when the Fed finally raises its short-term Fed Funds rate. What is most important at this time is for investors to anticipate these eventualities, understand this is what the market perceives, don???t fight the tape and enjoy the ride if/when this scenario unfolds.

In the meantime, investors can collect a blended yield of 10% from a widely diversified portfolio of income-generating, pass-through securities. Those securities are poised to be the "belle of the ball" when investors rotate out of long-dated fixed income into high-yield adjustable rate assets. With the 10-year T-Note yield jumping from 1.65% on Feb. 1 to 2.1% just three weeks later, that dance has already started.

In case you missed it, I encourage you to read my e-letter column from last week about the U.S. market's bullish turnaround. I also invite you to comment in the space provided below my commentary.