By Paul Dykewicz, StockInvestor.com

Southwest Airlines??? stock price soared the day after the recent death of its 87-year-old founder Herb Kelleher in what seems to be a fitting tribute to a corporate leader who started the company without any aviation experience and provided low-fare competition to rivals that tried and failed to squash his bold vision and determination.

The stock price of Southwest Airlines (NYSE:LUV) rose 4.92 percent, or $2.24 a share, on Jan. 4, the day after Kelleher died. Even though airline stocks generally climbed in unison that day, I can imagine the unbridled laughter of the fun-loving, people-focused Kelleher, as well as visualize a beaming smile on his face upon learning of the stock price???s take-off the day after his death.

I have special insights about Kelleher???s management style and Southwest???s corporate culture that I gleaned when I covered the industry as a beat earlier in my career and attended the company???s annual media day twice. I met and spoke with Kelleher, who graciously made himself and his fellow company leaders available to explain their mission of offering low fares and great service in an industry that sometimes provided neither.

Kelleher, who started an airline that has turned profits consistently for 46 straight years while also helping his passengers save money on their air fares, had dressed up as Elvis Presley, a woman, the Easter bunny, a leprechaun and a flight attendant over the years to promote Southwest Airlines. He also enjoyed cigarettes, Wild Turkey bourbon whiskey and performing in rap songs for employee training videos.

In addition, Kelleher famously settled a dispute involving the airline???s "Just Plane Smart" marketing slogan by arm wrestling. The tiff ended up resolved amicably with an agreement to share the slogan while raising money for the Muscular Dystrophy Association and Ronald McDonald House of Cleveland.

Southwest Airlines??? Stock Price Helped by Use of Boeing 737

I gained appreciation for Kelleher???s plan to use Boeing 737 aircraft exclusively to simplify training and operations for its flight crews, maintenance staff and ground employees. Use of the same aircraft type maximized efficiency by only requiring spare parts for the Boeing 737, by making the planes interchangeable and by standardizing how and where they can be parked on an airport apron since they have a common shape and size.

The media day events I attended provided an education in how Southwest Airlines differed from other carriers in important ways, such as its goal to hire, to retain and to reward employees who genuinely care about others and would convey that friendliness to passengers. I have attended a number of media events, and Southwest Airlines??? press days rank among the best for providing useful information and offering a chance to develop a rapport with its corporate leaders.

???Leadership is all about leading by example and taking ownership for everything,??? said Jim Woods, editor of Successful Investing, Intelligence Report and Bullseye Stock Trader. ???I know several Southwest employees who have told me that Kelleher???s treatment of fellow employees was as magnanimous and caring as it was for his customers. With comments like that from your workers, it???s not hard to see why this business genius succeeded so profoundly.???

Southwest Airlines??? Stock Price Has Been Helped by Leadership Succession

I also interviewed then-Chief Financial Officer Gary Kelly, who later rose to chairman and chief executive officer. In his 32-year career at Southwest Airlines, Kelly started as a controller before promotions to chief financial officer and vice president of finance, then executive vice president and CFO, prior to his elevation to chief executive officer and vice chairman in July 2004. In 2008, Kelly assumed the roles of chairman and president before relinquishing the latter title in January 2017.

Kelly???s longevity at the company is not without good reason, based on the airline???s financial outperformance of its industry rivals that in many cases have gone through at least one financial restructuring. Nonetheless, Southwest Airlines has the lowest operating cost in the industry and offers the least expensive and simplest fares, while letting each passenger check up to two bags at no charge even though other airlines require their customers to pay fees.

???I think Gary Kelly and the current management team are doing a great job,??? said Hilary Kramer, a seasoned Wall Street money manager who also leads the Value Authority, Turbo Trader and Inner Circle advisory services for individual investors. ???They're not going into debt to fund self-glorifying all-or-nothing strategic expansion. LUV has twice as much in assets for every $1 in debt than most of the majors - only Delta Air Lines (NYSE:DAL) has a balance sheet that can even remotely compare. This is an enterprise where people can feel comfortable giving their entire working lives and knowing it will still be around. LUV started as a disruptor; now it's the example other airlines try to match.???

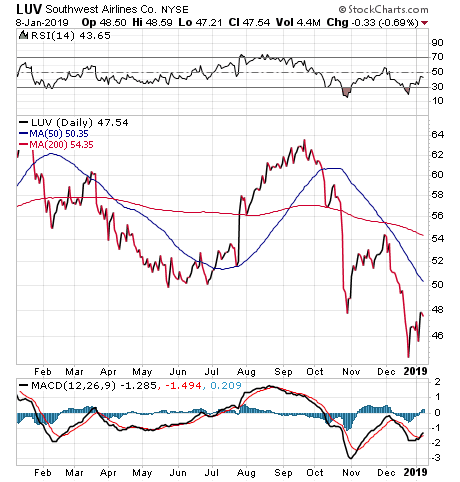

Chart Courtesy of stockcharts.com

Southwest Airlines??? Stock Price Fueled by Employees

Southwest Airlines??? emphasis on putting its workers ???first??? has differentiated it in an industry that historically has been characterized by ???unions, strikes and employee apathy,??? said Bryan Perry, who leads the Cash Machine advisory service.

Perry quoted Kelleher as saying, ???If you treat your employees right, guess what? Your customers come back, and that makes your shareholders happy. Start with employees and the rest follows from that.???

Kelleher shunned the "full service" business model that came with high fares and introduced a low-fare approach that maintained an egalitarian coach-only, first-come, first-served seating policy that remains in place today, Perry said.

???The company was also first to use only one model of airplane - the 737, which added to efficiencies in maintenance, training and flight planning,??? Perry continued. ???Additionally, Southwest's open seating approach was never really adopted by other major airlines but for those that like to be early and prompt and not pay a lot, it's their favorite airline by far.???

Southwest Airlines??? Stock Price Offers Value After Pullback

Perry is not currently recommending Southwest Airlines??? shares, but he said the stock is a ???much better value today??? than at any time in the past two years.

Stifel, a wealth management and investment banking company, rates Southwest Airlines as a ???buy??? and has placed an $85 price target on the stock. That target is 78.8 percent above LUV???s share price of $47.54 at the close of trading on Jan. 8.

Risks to the share price include a softening in pricing, potential increases in fuel prices, a slowdown in U.S. economic activity that may hurt passenger demand, potential fare price cuts by competitors and an adverse outcome from current labor contract negotiations. On the plus side, Southwest Airlines is seeking Federal Aviation Administration (FAA) approval to obtain extended range operation to begin flying from California to Hawaii. Stifel expects the FAA to clear the move and allow the airline???s first flight on that route in the second or third quarter of 2019.

Southwest Airlines??? Stock Price Rates a ???Hold??? by Zacks

Zacks gives Southwest Airlines its top rating of ???A??? in assessing its ???value??? but regards LUV as a ???hold??? due to a ???C??? grade for its growth outlook. The consensus of analysts??? estimates rates the stock as a buy, but their overall level of bullishness has dipped in the past two months along with the market.

Share-price drops of 16.08 percent and 10.71 percent for the stock in the past 12 weeks and eight weeks, respectively, have pushed its price-to-earnings (P/E) ratio down to a modest 10.08. Another indicator that may appeal to value investors is the airline???s price/earnings to growth (PEG) ratio of 0.90, which puts the stock on the ???buy??? side of a measure that views stocks below the 1.0 mark favorably.

Kelleher retired from Southwest Airlines in 2008, but the company retains his personal priority for cultivating good employee relations, offering friendly customer service and retaining its low-fare niche for point-to-point transportation that gives it an identity competing airlines only can try to match. He entered a fiercely contested industry and navigated the turbulence of competition to survive the airline???s early years when its flight attendants wore hot pants and go-go boots to compete with now-defunct Braniff Airways and others.

Now an industry leader, Southwest Airlines foregoes the fees of its rivals to let each passenger check two bags at no charge. Thanks to Kelleher, Southwest Airlines appears to be on a well-designed flight path.

Paul Dykewicz, www.PaulDykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor???s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore???s Daily Record newspaper. Paul also is the author of an inspirational book, ???Holy Smokes! Golden Guidance from Notre Dame???s Championship Chaplain,??? with a foreword by former national championship-winning football coach Lou Holtz.