Conventional wisdom explains that it is vitally important for any investor to diversify his or her holdings. This is intended to minimize risk from movements or events that disproportionately hurt one type of investment. A fund that offers a way to gain the benefits of diversification is Arrow Dow Jones Global Yield ETF (GYLD).

This fund takes a balanced multi-asset approach across five different strategies. Its holdings emphasize dividends and are based on five separate, specific indexes. It has approximately even holdings in equities, real estate, sovereign debt, corporate debt and alternative assets, with each subcategory targeted towards dividend-paying investments. As the fund’s name indicates, it includes positions from around the globe in each of these areas.

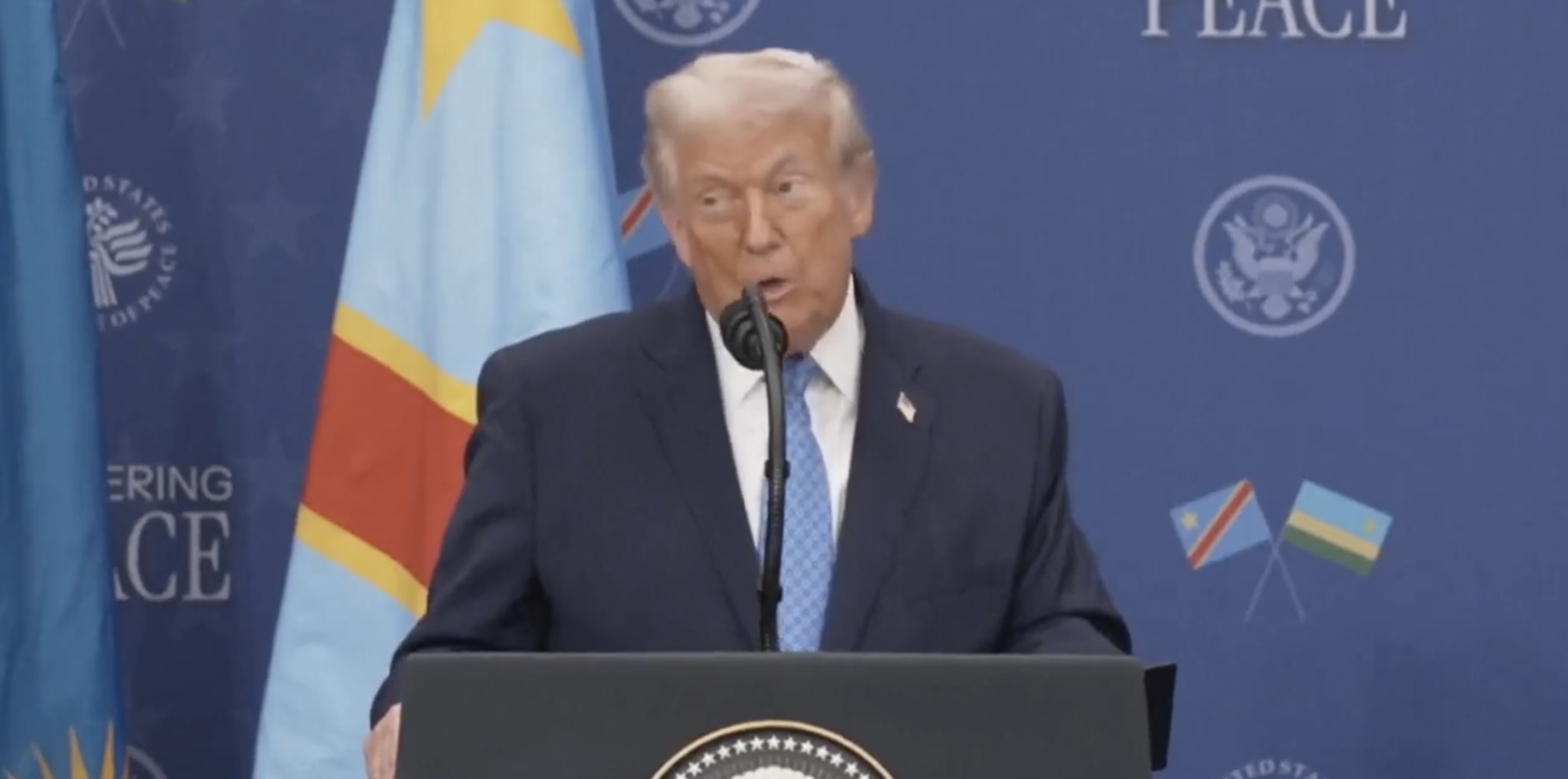

The fund pays out an overall yield of 7.91%, compared to an expense ratio of 0.75%, so investors are rewarded nicely for owning it. Though it has declined by 1.42% this year, when its monthly dividends are accounted for, investors in GYLD have profited in 2015 overall. The following chart shows the fund’s one-year performance.

In terms of individual positions, this fund allocates 8.36% of its assets to its top 10 largest positions. These include Shenzhen Investment Ltd., 1.12%; Ladbrokes PLC, 0.91%; Lewis Group Ltd., 0.87%; LRR Energy LP, 0.84%; and Chesapeake Granite Wash Trust, 0.81%.

In terms of sectors, the fund is most strongly allocated to real estate, financial services and utilities. GYLD’s portfolio of countries includes the United States, Australia, Singapore, France and many others.

For investors seeking a simple way to invest in a number of asset classes for a high and diverse yield, Arrow Dow Jones Global Yield ETF (GYLD) could be just what they want.

If you want my advice about buying and selling specific ETFs, including appropriate stop losses, please consider subscribing to my Successful ETF Investing newsletter. As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an e-mail. You just may see your question answered in a future ETF Talk.

In case you missed it, I encourage you to read my e-letter column from last week on Eagle Daily Investor about a global dividend ETF. I also invite you to comment in the space provided below my Eagle Daily Investor commentary.