Last week???s Federal Open Market Committee meeting came and went as most Fed watchers had expected, with the exception of one caveat. While it had been almost universally understood the Fed would leave short-term interest rates unchanged, it was the policy statement issued thereafter that caught Wall Street off guard - happily off guard to be exact.

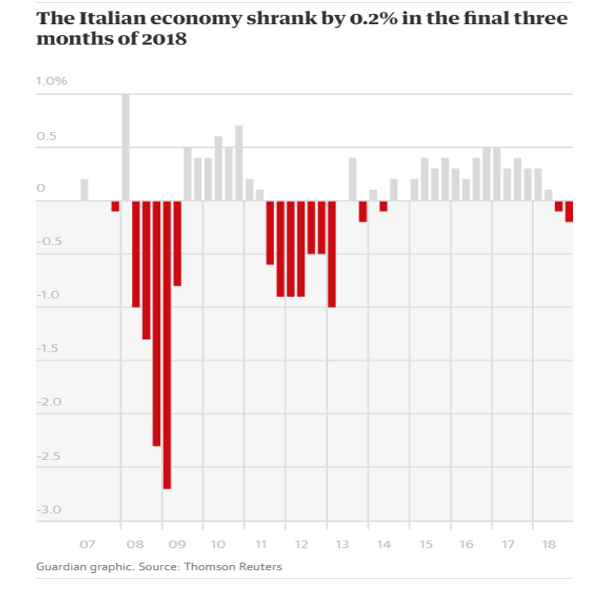

Within the policy statement, the word ???patience??? was used no fewer than eight times to describe the ???new normal??? for the Fed???s road map ahead. The statement also cited weaker macro conditions outside the United States that could negatively impact GDP (gross domestic product) growth over the course of 2019 and also placed more risk weighting on the second half of they year. China has seen its Purchasing Manufacturers Index (PMI) decline for two straight months and Italy is now officially in a recession after its GDP growth remained negative for two straight quarters.

Chart Courtesy of Thomson Reuters

There is also the prospect of the March 29 Brexit from the European Union that could provide some upheaval in the financial markets if there is a smooth transition deal that eventually leads to a ???hard Brexit??? exit. Toss in the possibility of a second government shutdown and the March 1 deadline for tariffs on Chinese imports to rise to 25% from 10% if no deal is cut between Presidents Trump and Xi - and it makes perfect sense for the Fed to just sit tight and let events unfold.

To read more, click here.